The Internal Revenue Service resurrected a form unused since the early 1980s. Form 1099-NEC (the NEC stands for non-employee compensation) is now back in use. This form is used to report non-employee compensation instead of the 1099-MISC.

The 1099-MISC has been used since 1983 to report payments to contract workers and freelancers to the IRS. It’s also been used to report rents, royalties, crop insurance proceeds and several other types of income unrelated to independent contractors. Congress mandated the revival of the 1099-NEC along with the passage of the PATH Act back in 2015. However, there have been complications implementing the form, so its use was delayed. It will now make its return debut in 2021 for payments made in 2020.

Why The Change Back to the 1099-NEC?

The reason for the change to the 1099-NEC is to control fraudulent credit claims. Specifically, claims for the earned income tax credit (EITC), which is based on earned income from working. Scammers were filing tax returns before the February 28 due date for 1099-MISC. And this early filing did not give the IRS the time to cross-check the earned income claimed in the returns. As a stopgap measure, 1099-MISC filings that included non-employee compensation were required to be filed by January 31. This is the same due date as W-2s, another source of earned income. By using the 1099-NEC for non-employee compensation, the IRS can eliminate the problems created by having two filing dates for the 1099-MISC. And thus, help control fraudulent claims.

As a result, the 1099-MISC has been revised. Box 7—where non-employee compensation used to be entered—is now a checkbox. This checkbox states for “Payer made direct sales of $5,000 or more of consumer products to a buyer (recipient) for resale.” Other boxes after Box 7 have also been reorganized.

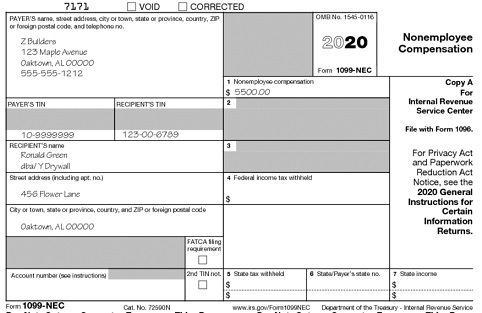

The 1099-NEC is quite simple to use since it only deals with non-employee compensation (Box 1). And there are entries for federal and state income tax withholding.

Sample 1099-NEC form

All business owners that engage the services of an individual (independent contractor), that is paid $600 or more for the calendar year are required to issue that individual a Form 1099-NEC. To avoid penalties, this form must be issued immediately following the end of the year. Issuing the form in a timely manner also helps one avoid the prospect of losing the deduction for his or her labor and expenses in an audit.

1099-NEC Due Dates

The due date for filing a 1099-NEC with the IRS and mailing the recipient a copy of the 1099-NEC that reports 2020 payments is February 1, 2021.

It is not uncommon to have a repairman out early in the year, pay him less than $600, then use his services again later in the year and have the total for the year exceed the $599 limit. As a result, many folks forget to get the information needed to file a 1099. Therefore, it is good practice to always have individuals who are not incorporated complete and sign an IRS Form W-9 the first time you engage them and before you pay them.

Having a completed and signed Form W-9 for all independent contractors and service providers eliminates any oversights. And this form protects you against IRS penalties and conflicts.

It’s a good idea to establish a procedure for getting each non-corporate independent contractor and service provider to fill out a W-9 and return it to you at the beginning of each job.

IRS Form W-9, Request for Taxpayer Identification Number and Certification, is a form to help you collect vendors’ data you’ll need to accurately file the 1099s. It also provides you with verification that you complied with the law in case a vendor gave you incorrect information. We highly recommend that you have potential vendors complete a Form W-9 prior to engaging in business with them. The W-9 form isn’t submitted to the IRS. It’s for your use only.

Penalties for Filing Incorrectly

The penalties for failure to file the required informational returns are $280 per informational return. The penalty is reduced to $50 if a correct but late information return is filed no later than 30 days after the required filing date. Or it is reduced to $110 for returns filed after the 30th day but no later than August 1, 2021. If you are required to file 250 or more information returns, you must file them electronically.

In order to avoid a penalty, copies of the 1099-NECs you’ve issued for 2020 need to be sent to the IRS by February 1, 2021. They must be submitted on magnetic media or on optically scannable forms (OCR forms).

Nissen and Associates can help you prepare 1099s for submission to the IRS. We provide recipient copies and file copies for your records. Use the 1099 worksheet to provide this office with the information needed to prepare your 1099s.

Paying Too Much Interest on Your Home Mortgage?

Paying Too Much Interest on Your Home Mortgage?