In 2021, required minimum distributions (RMDs) will resume as they were before the pandemic. As part of the CARES Act, the requirement for older taxpayers to take RMDs from their retirement plans was waived for 2020. This was due to the anticipated drop in value for most investments as a result of the economic effects of COVID-19. However, despite everything else, the drops in the market did not materialize.

So, barring any extension of the 2020 moratorium by Congress, RMDs will resume for the 2021 tax year.

What are the 2021 Required Minimum Distributions?

RMDs are required distributions from qualified retirement plans and commonly are associated with traditional IRAs, but they also apply to 401(k)s and SEP IRAs. The tax code does not allow taxpayers to keep funds indefinitely in their qualified retirement plans. Eventually, these assets must be distributed, and taxes must be paid on those distributions. If a retirement plan owner takes no distributions, or if the distributions are not large enough, then he or she may have to pay a 50% penalty. However that penalty is based only on the amount that should have been distributed, but was not.

If you turned age 70½ before 2020 or turned 72 in 2020, you are already subject to the RMD requirement. This means you must take a distribution in 2021. If you turn 72 in 2021, you must begin taking RMDs in 2021. However, the first year’s distribution for 2021 can be delayed. The last day to take that distribution is April 1, 2022. However, using that date – that means you would have to take two distributions in 2022, which may or may not be beneficial to your taxes.

Uniform Lifetime Table and what it means

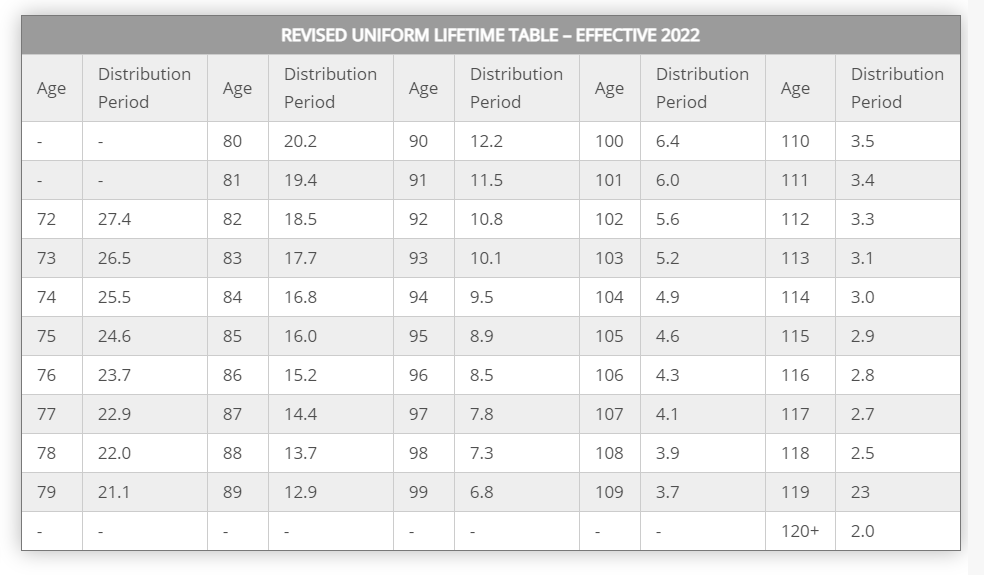

The amount you are required to withdraw is based upon the value of the IRA account on December 31 of the prior year divided by the “distribution period” (your life expectancy). The number is generally is found in the Uniform Lifetime Table for the year of distribution. Historically, the Uniform Lifetime Table – created by the IRS – has remained unchanged. But beginning with distributions in 2022, the IRS has developed a new table that reflects a longer life expectancy. Both are illustrated below.

If you have more than one IRA, the RMD for each one is figured separately. But you may add up all of the RMDs and take the total amount required for the year from any one or a combination of the IRAs.

2021 Required Minimum Distribution Timetable

| Age | Distribution Period | Age | Distribution Period | Age | Distribution Period | Age | Distribution Period | Age | Distribution Period |

| 70 | 27.4 | 80 | 18.7 | 90 | 11.4 | 100 | 6.3 | 110 | 3.1 |

| 71 | 26.5 | 81 | 17.9 | 91 | 10.8 | 101 | 5.9 | 111 | 2.9 |

| 72 | 25.6 | 82 | 17.1 | 92 | 10.2 | 102 | 5.5 | 112 | 2.6 |

| 73 | 24.7 | 83 | 16.3 | 93 | 9.6 | 103 | 5.2 | 113 | 2.4 |

| 74 | 23.8 | 84 | 15.5 | 94 | 9.1 | 104 | 4.9 | 114 | 2.1 |

| 75 | 22.9 | 85 | 14.8 | 95 | 8.6 | 105 | 4.5 | 115+ | 1.9 |

| 76 | 22.0 | 86 | 14.1 | 96 | 8.1 | 106 | 4.2 | – | – |

| 77 | 21.2 | 87 | 13.4 | 97 | 7.6 | 107 | 3.9 | – | – |

| 78 | 20.3 | 88 | 12.7 | 98 | 7.1 | 108 | 3.7 | – | – |

| 79 | 19.5 | 89 | 12.0 | 99 | 6.7 | 109 | 3.4 | – | – |

Determining the 2021 Required Minimum Distributions

Determining the Total Value:

The total value is based on the employer-sponsored retirement plan’s or the IRA’s account value at the end of the business day on December 31st of the PRIOR year. If the first-year distribution is delayed to the subsequent year, the 12/31 value is not reduced by the first-time RMD taken between January 1 and April 1 in the year following the end of the year when the taxpayer reaches the mandatory distribution age.

Determining the 2021 Required Minimum Distributions Period

In addition to the two tables above, the IRS provides an additional table. This table is called the Joint and Last Survivor Table. This table determines the RMD when

- the spouse is the sole beneficiary and,

- is more than 10 years younger than the IRA account owner is.

That table is not illustrated here because of its size.

Example:

Don’s oldest age during 2021 was 75. He has an IRA account with a value of $150,000 at the close of business on 12-31-20. Using the Uniform Lifetime Table, we find that the distribution period for age 75 is 22.9 years. Thus, Don’s RMD for 2021 is $6,550 ($150,000/22.9 years).

If the taxpayer doesn’t withdraw the $6,550 during 2021, then he will be subject to a penalty. This would be a penalty of 50%, or $3,275 ($6,550 x 50%). Under certain circumstances, the IRS will waive the penalty if the taxpayer can demonstrate reasonable cause. AND that taxpayer must make up the withdrawal soon after discovering that there was a shortfall in the distribution. However, the hassle and extra paperwork involved to waive the penalty make it something you want to avoid. Our recommendation? Take the correct distribution amount in a timely manner. Some states also penalize under-distributions.

IRA Limitations

There is no maximum limit on distributions from a traditional IRA. This means as much can be withdrawn as the owner wishes. However, if more than the required distribution is taken in a particular year, the excess cannot be applied toward the minimum required amounts for future years.

IRAs and Tax Deductions

Because traditional IRA contributions are tax-deductible, distributions from these IRAs generally will be fully taxable. However, in some circumstances, the taxpayer may have been unable to deduct the entire contribution amount. For example, if the taxpayer was a participant in an employer’s retirement plan and had an AGI that exceeded the annual income limitation for the contribution year. Or, the taxpayer may have elected to make the contribution nondeductible. In either of these situations, a portion of each year’s IRA distributions will be nontaxable. But for most taxpayers, any distribution from their IRAs will be taxable. Thus many IRA owners may want to take heed when Congress provides an opportunity to reduce the tax on their RMDs, as explained next.

Charity Tax Provisions

A provision of the tax code allows a taxpayer to contribute up to $100,000 of his or her IRA funds to a charity by directly transferring the IRA funds to the charity. In doing so,

- the transfer counts toward the RMD requirement,

- the amount transferred is not taxed as income, and

- no charity deduction is claimed.

Advantages

An advantage of this provision is that a taxpayer can take the standard deduction and still benefit from the charitable donation. It also prevents the IRA distribution from being included in the taxpayer’s AGI. Which means it could potentially cause less of their Social Security income to be taxed. Therefore reducing the effect of higher AGI phase-outs.

Even though an IRA owner whose total income is less than the return-filing threshold is not required to file a tax return, the RMD rules still apply. This means they could be liable for the under-distribution penalty, even if no income tax would have been due on the under-distribution.

In many cases, advance planning can minimize or even avoid taxes on traditional IRA distributions. Often, situations will arise in which a taxpayer’s income is abnormally low due to losses, extraordinary deductions, etc., and taking more than the minimum in a year might be beneficial. This is true even for those who may not need to file a tax return but can increase their distributions and still avoid any taxes.

If you need help with tax planning, please call this office for assistance.

Tax Court Decision Holds Potential Impact for Travel Deductions

Tax Court Decision Holds Potential Impact for Travel Deductions