Minimize a Surviving Spouse’s Estate Tax: The Benefits of the Portability Election

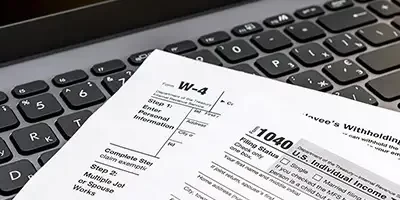

The Form 706, also known as the United States Estate (and Generation-Skipping Transfer) Tax Return, is a critical document in estate planning and tax management. One of its significant features is the portability election. This election allows a surviving spouse to utilize their deceased spouse’s unused estate tax exclusion amount. This article delves into the …