Frequently Asked Questions About the Secure Client Portal

Q: How do I log in to my secure client portal?

You may have received an email from us with your link and password. If so, follow the link provided to access your portal. Please add bellinghamtax@atomanager.com to your contacts list to ensure that you receive all of the real-time updates and notifications sent to you through our secure portal service.

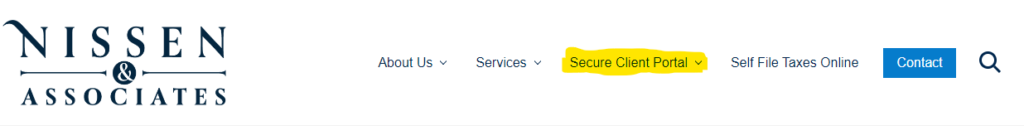

If you’ve never requested access to your portal, visit our BellinghamTax website to find the link to the portal. The link is located on our main menu bar.

Path: BellinghamTax.com > Secure Client Portal

Direct Link: https://login.atomanager.com/ATOM_NAA/WebInfo.aspx

Direct Link: https://login.atomanager.com/ATOM_NAA/WebInfo.aspx

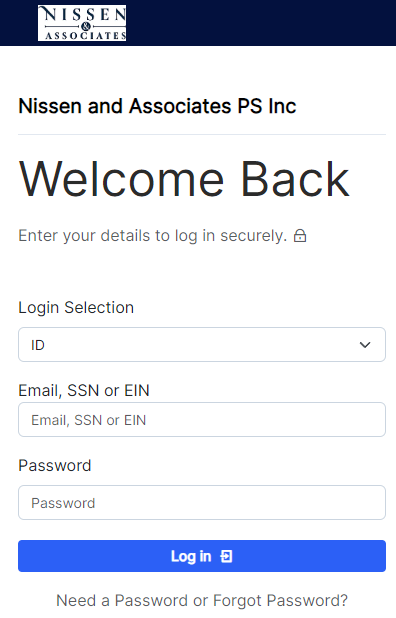

Q. Should I use the ID or Email option to log in to my portal account?

If you are new to our office, we recommend that you use the email address we have on file to access your portal. Once you are an established client, you may use your account’s SSN or EIN as the account ID to log in to your secure portal.

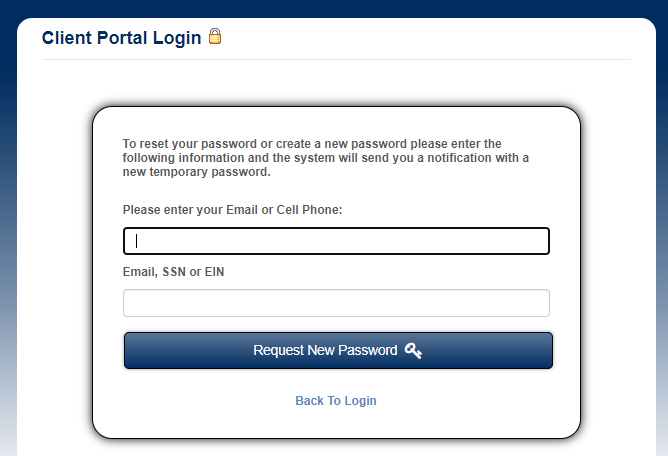

Q: I forgot my password, or never received a password. How can I gain access to my secure client portal?

- Go to our portal login page

- Click on the “Need a Password or Forgot Password?” link at the bottom of the Portal screen.

- Select the option to have your temporary password emailed to you. The Portal will automatically generate and send a new password to the email we have on file for your account.

NOTE: Do not choose the option to have the password sent to your cell phone. We do not currently subscribe to that option, and unfortunately cannot remove it from the password retrieval screen.

Need to update your account email? Call the office at (360) 778-2901 and we’ll be happy to update that for you.

Q: Do my spouse and I have separate portals? Do we each need login credentials to access the Portal?

- Households with taxpayers filing joint tax returns share the portal.

- Households who file separate returns will have separate portals and separate log-in credentials.

Portals may be linked upon request, so that spouses can have access to each other’s documents, if desired.

NOTE: The Portal is linked to the spouse who is in the Taxpayer #1 position on your tax return.

Use that person’s email address and password to log in to the Portal.

Q: I have a business account AND a personal account with you. How does that work with the portal?

That depends on your preference.

The Secure Client Portal is set up by default to have separate portals for each tax-paying entity. For example, if you file FORM 1040 for your household, and FORM 1120S for your business, each of those different types are set up to have individual portals for document upload, signing, scheduling appointments, etc. You may gain access by using the email account set up in the primary taxpayer position for each account.

** READ THIS if you are using same email address for more than one account **

If we have the same email address listed for more than one account type in our system, you may have trouble logging in the first time. Please call our office and we can correct the issue over the phone.

If you would like to have access to both account types through one log-in, we can link your accounts. Please call our office to set that up. You may choose different levels of access depending on your individual situation. For example, you and your spouse both want access to your business account, and you have employees who should have access to the business but not your personal account. We can set up your link so that access only flows one direction, from your personal portal to your business portal, but not vice-versa. We can also link an employee to your business account, but you would not have access to their personal portal. If you have a small business and want access to flow either way, we can set up the link for that too.

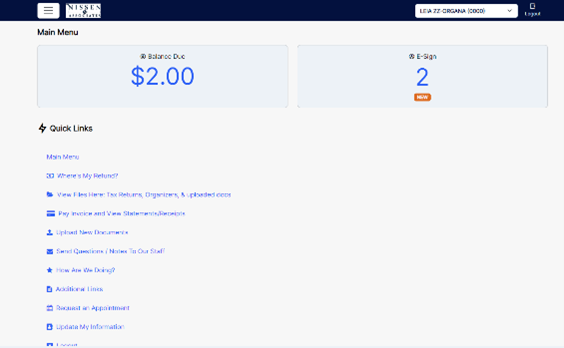

Q. How do I switch between linked accounts?

Log in to your portal then look at the top right corner of the main menu page. It should now be a drop-down list. From here, you can toggle between your authorized accounts to view and sign documents, upload documents, ask questions, or request appointments for each of your accounts.

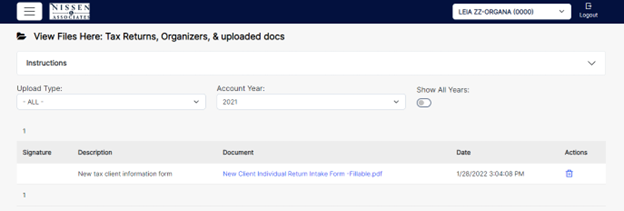

Q: I’m looking for copies of past tax returns but don’t see them. How do I access those files?

The Secure Client Portal service does not automatically import all of your past documents and returns. If you need access to specific returns or other documents, please call or email our office and we will manually transfer them into the new portal, usually within one working day of receiving your request, during our regular office hours.

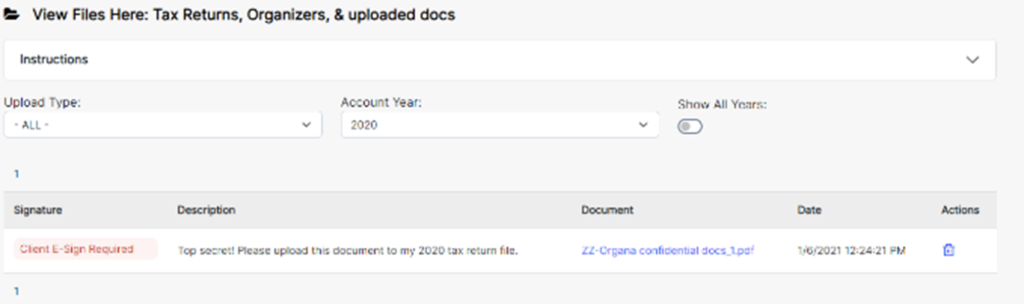

One the files have been uploaded to your portal, click on the View Files Here link in the main menu to go to the View Files page. Form there, you will see lists of your documents, and can sort them by type or by account year. Click on the hyperlinked Document Title to open and view your documents.

Q: How do I e-sign a document?

You will receive an email from bellinghamtax@atomanager.com when there is a new document available for e-sign in your portal. Please read the entire email before signing your documents. The email contains detailed information to help walk you through the e-sign process.

General Instructions to e-sign a document

- Log in to your portal.

- Look for the e-sign task bubble on the Main Menu screen, click on the task bubble or go directly to the View Files Here page.

- Look for the red Client E-Sign Required link to the left of the document description

- Fill out the information requested in the Electronic Signature pop-up form, and click on the E-Sign Client button at the bottom to save your e-signature.

**If the document also requires a signature from your spouse:

You should be able to close the dialog box after the first signer completes the e-signature process. Back on the main menu screen, you should still see the text highlighted in red that shows the Spouse e-signature is required. Click on the link and follow the prompts to verify the identity and signature of the second signer.

Our office will automatically receive notification when you verify your signature.

Note: The system will allow you three attempts to complete the e-signature process. Please call our office if you have exceeded your attempt limit and need to reset the system.